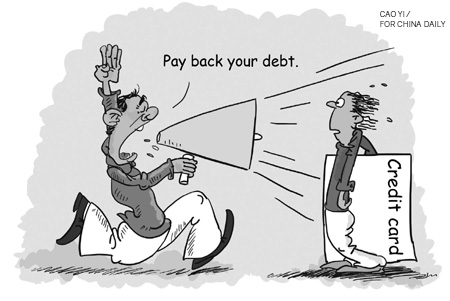

It is not uncommon for anyone to have a debt problem at least once in their lives. Emergencies can happen or a variety of circumstances can occur that lead to debt quickly. If this happens and you have a hard time keeping up with the payments you can expect to start getting some calls from credit card collectors asking for payments. How can you effectively handle these calls?

How to handle calls from debt collectors

The first thing you need to know before you talk to a debt collector are your rights. Some collectors can get very nasty on the phone and you need to know beforehand if what they are saying is true. If they tell you anything that is false you can stop them on the spot and let them know that you have done your homework and they are not allowed to say these things. In fact, there are things that collectors are not allowed to say or do or they can lose their license and get investigated by the ACCC or the ASIC.

Here is a list of the things that the creditors are not allowed to do or say.

- Try to intimidate or scare you.

- Threaten to put you in jail.

- Give any threat of violence.

- Call at odd hours or call providing a message that is the same over and over again.

- Threaten to let your family, friends or employer know about your debt without first giving your authorization.

- Refuse to give you the debt details.

What debt collectors can do

What debt collectors can do- Make reasonable contact with you during reasonable hours.

- Sue you for the money if you refuse to pay or make future arrangements.

- Take repossession of some property and try to start proceedings for bankruptcy against you.

The four stages of debt collection

- The first thing a collection company will do is send you letters in a sequence to ask for the repayment of money. These letters will become more urgent as each one is sent.

- If they don't get a response from sending out the letters they will start to call you. Usually the calls begin as being pleasant and then work their way towards becoming assertive.

- Legal action is started in the phone calls don't work. If you owe more than $3000 legal action will be considered. If you don't win this legal case your credit file will be marked.

- Bankruptcy or repossession is the next step the debt collectors have the right to take. Bankruptcy is only usually considered for a high debt, but if this action is taken and you are declared bankrupt your credit file will be in serious danger.

There is a lot of administration costs to collecting a debt and you can often work out a payment arrangement where you pay in installments or offer to pay a lump sum that has been reduced. The collection company will accept offers at their own discretion so it is not guaranteed that you will be able to work out the exact arrangement that you want, but they are usually flexible. If you do work out a deal make sure that you get everything in writing before proceeding to make payments.

No matter how aggravated you may get at times with debt collectors, remember that working things out is really in your best interest. After all, you don't want to end up having to deal with your debt legally.

This article was written by personal finance writer Timothy Ng from Sydney, Australia. He is genuinely passionate about helping people compare credit cards and helping them through researching to find the best credit card.

4:02 AM

4:02 AM

Neo Anderson

Neo Anderson

3 comments:

good points

you can negotiate for pennies on the dollar when the debt gets sold multiple times.....plus, 97% of all bankruptcies never had to happen in the first place, people just pulled the trigger to fast and/or where not educated enough about the process

You are absolutely correct Gregg.

Most of the bankruptcies are mainly due to partial knowledge about their dollars.

If you are residing in or around Kansas City or Lees Summit, Missouri, online loans are helpful and easy to get. I read this here: Online loans for Kansas City, Missouri You most often will not have to fax paperwork back and forth for these loans. You won't have to worry about a credit check, either -- most payday loans don't require them. Some traditional financial loans take weeks to get. These American money advances take as little as 2 hrs.

Post a Comment